4.4 The Economic Environment

Adapted by Stephen Skripak with Ron Poff

If you plan to do business in a foreign country, you need to know its level of economic development. You also should be aware of factors influencing the value of its currency and the impact that changes in that value will have on your profits.

Economic Development

If you don’t understand a nation’s level of economic development, you’ll have trouble answering some basic questions, such as: Will consumers in this country be able to afford the product I want to sell? Will it be possible to make a reasonable profit? A country’s level of economic development can be evaluated by estimating the annual income earned per citizen. The World Bank, which lends money for improvements in underdeveloped nations, divides countries into four income categories:

World Bank Country and Lending Groups (by Gross National Income per Capita 2021)[1]

- High income—$12,536 or higher (United States, Germany, Japan)

- Upper-middle income—$4,046 to $12,535 (China, South Africa, Mexico)

- Lower-middle income—$1,036 to $4,045 (Kenya, Philippines, India)

- Low income—$1,035 or less (Afghanistan, South Sudan, Haiti)

Note that that even though a country has a low annual income per citizen, it can still be an attractive place for doing business. India, for example, is a lower-middle-income country, yet it has a population of a billion, and a segment of that population is well educated—an appealing feature for many business initiatives.

The long-term goal of many countries is to move up the economic development ladder. Some factors conducive to economic growth include a reliable banking system, a strong stock market, and government policies to encourage investment and competition while discouraging corruption. It’s also important that a country have a strong infrastructure—its systems of communications (telephone, Internet, television, newspapers), transportation (roads, railways, airports), energy (gas and electricity, power plants), and social facilities (schools, hospitals). These basic systems will help countries attract foreign investors, which can be crucial to economic development.

Currency Valuations and Exchange Rates

If every nation used the same currency, international trade and travel would be a lot easier. Of course, this is not the case. There are around 175 currencies in the world: Some you’ve heard of, such as the British pound; others are likely unknown to you, such as the manat, the official currency of Azerbaijan. If you were in Azerbaijan you would exchange your US dollars for Azerbaijan manats. The day’s foreign exchange rate will tell you how much one currency is worth relative to another currency and so determine how many manats you will receive. If you have traveled abroad, you already have personal experience with the impact of exchange rate movements.

The Legal and Regulatory Environment

One of the more difficult aspects of doing business globally is dealing with vast differences in legal and regulatory environments. The United States, for example, has an established set of laws and regulations that provide direction to businesses operating within its borders. But because there is no global legal system, key areas of business law—for example, contract provisions and copyright protection—can be treated in different ways in different countries. Companies doing international business often face many inconsistent laws and regulations. To navigate this sea of confusion, American business people must know and follow both US laws and regulations and those of nations in which they operate.

Business history is filled with stories about American companies that have stumbled in trying to comply with foreign laws and regulations. Coca-Cola, for example, ran afoul of Italian law when it printed its ingredients list on the bottle cap rather than on the bottle itself. Italian courts ruled that the labeling was inadequate because most people throw the cap away.[2]

One approach to dealing with local laws and regulations is hiring lawyers from the host country who can provide advice on legal issues. Another is working with local businesspeople who have experience in complying with regulations and overcoming bureaucratic obstacles.

Foreign Corrupt Practices Act

One US law that creates unique challenges for American firms operating overseas is the Foreign Corrupt Practices Act, which prohibits the distribution of bribes and other favors in the conduct of business. Unfortunately, though they’re illegal in this country, such tactics as kickbacks and bribes are business-as-usual in many nations. According to some experts, American businesspeople are at a competitive disadvantage if they’re prohibited from giving bribes or undercover payments to foreign officials or business people who expect them. In theory, because the Foreign Corrupt Practices Act warns foreigners that Americans can’t give bribes, they’ll eventually stop expecting them.

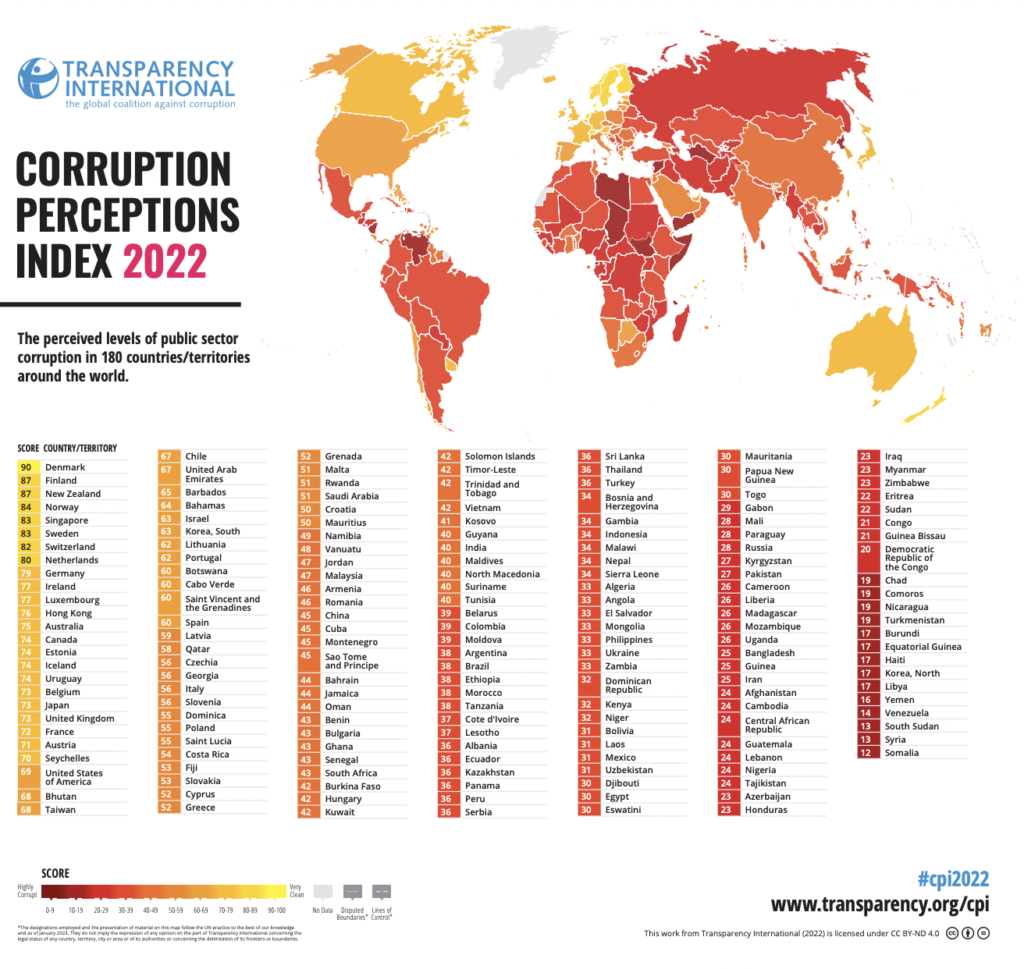

Where are American businesspeople most likely and least likely to encounter bribe requests and related forms of corruption? Transparency International, an independent German-based organization, annually rates nations according to “perceived corruption,” (see Figure 4.9) which it defines as “the abuse of entrusted power for private gain.”[3]

Case Study: Economic and International Impact of the US Hospitality & Tourism

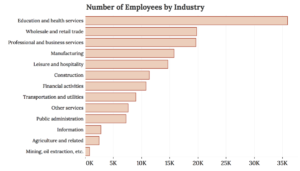

According to the US International Trade Administration, the travel and tourism industry in the United States generated $1.6 trillion in economic output and 7.8 million US jobs in 2013, with nearly 1 in 18 Americans employed directly or indirectly in a travel or tourism-related industry.[4] The Bureau of Labor of Labor Statistics indicates that an even higher percentage (11 percent) of US jobs are in the Leisure and Hospitality sector.[5]

While the majority of travel, tourism and hospitality in the US tourism industry is domestic, the US leads the world in international travel and tourism exports (i.e., travelers from other countries visiting the United States) with 15 percent of global traveler spending. Travel and tourism ranks as the top services export, accounting for 31 percent of all US services exports in 2014.

Expenditures by international visitors in the United States translate to economic impacts and jobs: including: $220.8 billion in sales, a $75.1 billion trade surplus, and 1.1 million total jobs in 2014.[6] The sector is poised to grow: the latest US Commerce Department international travel forecast estimates a 20 percent increase in international visitors in 2020 in comparison to 2014.[7]

Key Takeaways

- If you plan to do business in a foreign country, you need to get to know its level of economic development, the factors influencing the value of its currency and the impact that changes in that value will have on your profits.

- One of the more difficult aspects of doing business globally is dealing with vast differences in legal and regulatory environments.

- World Bank Group (2016). “Country and Lending Groups.” Retrieved from: http://data.worldbank.org/about/country-and-lending-groups ↵

- David Ricks (1999). Blunders in International Business. Malden, MA: Blackwell. p. 137. ↵

- Transparency.org (2016). “What is Corruption?” Retrieved from: http://www.transparency.org/ ↵

- International Trade Administration, Industry and Analysis, National Travel and Tourism Office (2015). “Fast Facts: United States Travel and Tourism Industry 2014.” Retrieved from: http://travel.trade.gov/outreachpages/download_data_table/Fast_Facts_2014.pdf ↵

- U.S. Department of Labor, Bureau of Labor Statistics (2015). “Employment Projections: Employment by Major Industry Sector.” Retrieved from: http://www.bls.gov/emp/ep_table_201.htm ↵

- International Trade Administration, Industry and Analysis, National Travel and Tourism Office (2015). “Fast Facts: United States Travel and Tourism Industry 2014.” Retrieved from: http://travel.trade.gov/outreachpages/download_data_table/Fast_Facts_2014.pdf ↵

- U.S. Department of Commerce, International Trade Administration (2015). “U.S. Commerce Department Releases Six-Year Forecast for International Travel to the United States: 2015-2020.” Retrieved from: http://travel.trade.gov/view/f-2000-99-001/forecast/Forecast_Summary.pdf ↵